What does it do?

Trisura is an insurance holding company that was spun-out of Brookfield Asset Management in 2017. It provides insurance for surety bonds, warranty programs, and corporate insurance policies. These niche insurance products are held on their books or created as a part of a fronting operation to allow others in the insurance stack to gain access up and downstream from their core business for a fee.

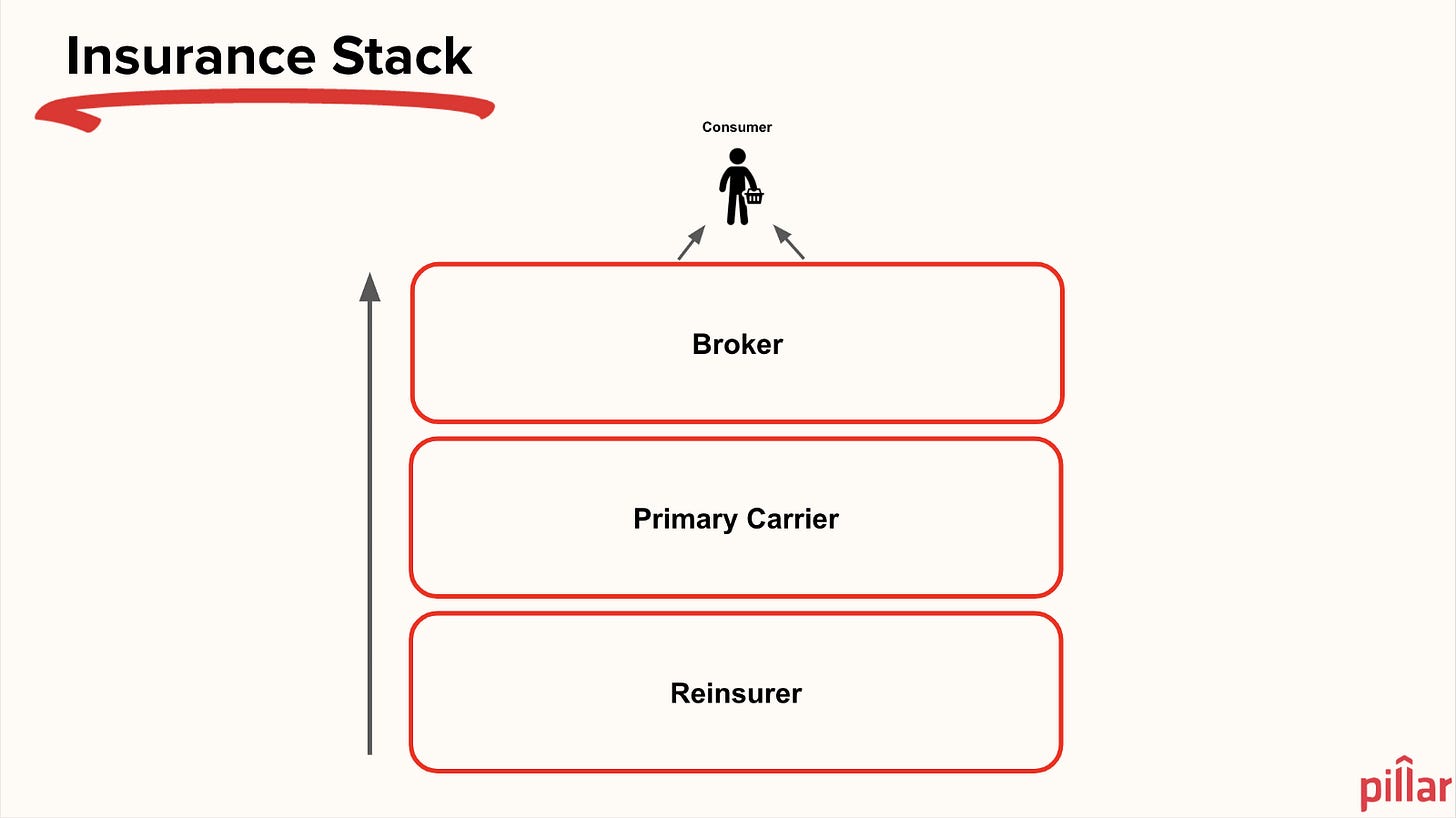

It is worthwhile at this point to review the insurance stack and where it is moving. An article by Parker McKee titled “The Insurance Stack: A Battle for Margin” is an excellent primer.

Brokers and Managing General Agents (MGAs) are becoming underwriters without the need for having an insurance business’s surplus capital and much less regulatory oversight via the use of technology. Primary carriers looking to expand their profit margins are trying to expand their distribution and retain more risks on their balance sheets. Reinsurers battling with alternative capital competition are seeking to move up the stack into customer’s space for better returns. Primary carriers and reinsurers, although have underwriting capacity, may not have the experience to write policies well (especially in niche areas), nor have an existing efficient distribution method.

Fronting provides a common point for insurance players to access regulated capital and distribution that otherwise require a lot of money, time, and talent to build. Fronting could be considered insurance infrastructure-as-a-service. An effective fronting platform would provide those at the top of the stack access to regulated capital, solve the regulatory requirement issues, and connect them with primary carers and reinsurers who are willing to assume risks in pursuit of a larger footprint and larger margins without increasing their expense ratios.

Trisura has a Canadian operation that is focused in niche insurance areas such as surety, warranties, and corporate insurance since 2006. These areas typically command higher premiums than more commodity insurance products such as Life insurance as the risks are more esoteric and specific to the situation. This is evident by having lower loss ratios and higher expense ratios. Trisura Canada has a loss ratio of ~25%, an expense ratio of ~60% for a combined ratio of 85%. The average US property and casualty insurer has 10-year mean loss ratio of 72.5% and expense ratio of 27.8% from 2009-2018 according to the National Association of Insurance Commissers (NAIC).

Trisura, in 2018, started a hybrid fronting entity for non-admitted US markets. This means that it participates with non-regulatory players in a specific jurisdiction or in higher risk policy underwriting for end-customers that are not able to obtain insurance from their local admitted insurers. It is currently licensed in 46 out of 50 states, with plans to obtain licenses in all 50. The act of fronting allows a non-regulated entity to use Trisura’s license to issue an insurance policy. Trisura enters into a contract with this entity to pass through the policy premiums less a fee (in the range of 3-4% of gross premium written). This contract also passes through any claims back to the entity. Trisura has to underwrite this entity’s ability to pay these liabilities and may require a capital buffer. Trisura retains ~5%-10% of the risks on its books to align itself with its partners. So on top of the fees, it will also earn premiums that are not claimed as underwriting revenues. This measured by their fronting operational ratio (the sum of claims, acquisition costs, and operating expenses divided by the sum of net premium earned and fronting fees). This ratio was 71% and 85% in 2020 and 2019 respectively.

These two divisions are the most important, but Trisura also has a 3rd legacy reinsurance division that as been operating for 18 years (2002) but stopped underwriting for 3rd parties since 2008. Originally it was in run-off but with the start-up of their US fronting operations, they are feeding premiums into their reinsurance arm. It suffered some losses as a result of asset-liability mismatching, but via an external investment manager re-positioned it after April 1, 2020.

Industry Trends

The Excess and Supply (E&S) insurance industry is currently in a hard-market (meaning that policy pricing is more favourable towards the insurer). Many admitted Property and Casualty (P&C) insurers are exiting unprofitable business lines and not renewing their policies. This reduced supply has shifted towards increased demand in the non-admitted market channels. Over the past 8-9 years, E&S insurance accounted for ~5-10% of the P&C market. This is expected to grow to 15-20% of the market. This trend started in 2019 and continued through 2020 (link, Trisura 2020 Investor Presentation). E&S policy premiums have also increased significantly in 2020 and expected to grow in 2021 (albeit a slower rate), due to continued factors such as “tightening market conditions (rate increases, stricter coverage terms and conditions, and reduced capacity); the low interest rate environment, which is challenging insurers’ underwriting profitability; social inflation and increased claims costs; more frequent severe weather events; and a big question mark over the country’s economy.” (link)

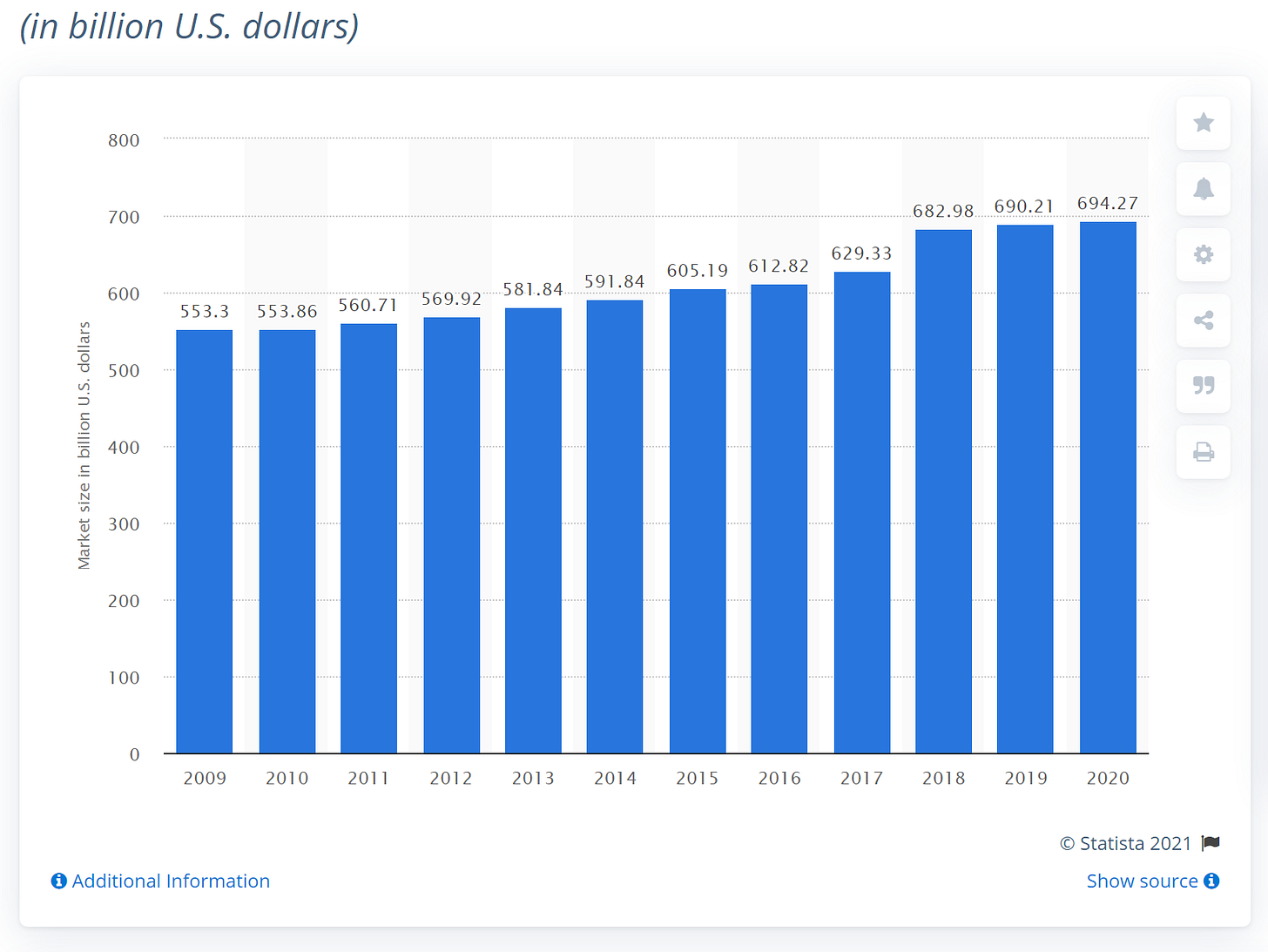

According to Statista, the US P&C insurance industry market size from 2009 to 2020 is shown below.

Trisura’s Q4 2020 investor presentation estimates the US market to be ~ $712.5 billion in 2019 with an E&S market size of $40.2 billion. The Canadian market is significantly smaller with a P&C market size of $72.2 billion and specialty market size of $5.8 billion. This non-admitted market has better economics relative to the broad P&C industry. It has a 10 year average (2009-2018) loss ratio of 62.6%, combined ratio of 95%, and pre-tax ROE of 10%. Over the 5 years, the E&S market has grown 7-8% annually vs the P&C industry’s 5-6% across North America.

In their 2020 annual report, it describes the US E&S insurance market as somewhat fragmented. Trisura estimates that the top 10 players have 40% of the market share, with the top 25 players averaging 2% of the market share. ie the top 10 have 4% each, the next 15 have 0.67% each. This is in contrast to the P&C market, where the top 25 players occur 66% of the market with the top 5 players having 9%, 6.5%, 5.5%, 5% and 5% respectively (link). The E&S market is exclusively focused on commercial lines whereas the standard P&C is evenly divided between personal and commercial. These specialty commercials are less commoditized, have more pricing and policy flexibility, lower loss ratios, and the distribution is usually via managing general agents.

People and their incentive alignment

The success of an insurance companies is highly dependent on management and its investment strategy. The inherent leverage with insurance liabilities magnifies management’s business execution.

David Clare was appointed CEO in 2018 with the spin-out of Partner’s Value Investment Inc. He graduated from Queen’s University with a Bachelor’s in business with the Class of 2008. He joined Partner’s Value Investment LP as a Vice President in 2015 and acted as Trisura’s Chief Investment Officer since 2017. Perhaps the most fascinating aspect is that David is 34 years old. He has no MBA, PhD, nor was ever a founder.

Asides from the above, there is not a lot known about David Clare to a financial outsider. David reaching this career point at this age is impressive. I can imagine two possibilities: 1) He has close connections into the Partner’s Value ecosystem and given privileged access to opportunities due to his relationships, or 2) he is extremely talented and Partner’s recognizes this. I am leaning towards the latter.

Partner’s Value Investment Inc and Partner’s Value Investment LP currently owns 1.56% and 9.87% of Trisura shares respectively. The LP previously sold down ~ 40% of its shares in 2020. The motivation of this is likely to return capital to its LP partners especially with the share price run-up. Partner’s is reputed to be a top-notched capital allocator. It would extremely unusual for Partner’s to appoint an incompetent manager and still have a decent amount of skin-in-the-game. (Recall that Bruce Flatt was became CEO of Brookfield Asset Management in 2002 when he was just 35 years old.)

David Clare currently owns ~ 0.35% of shares. He recently (2021) sold down ~50% of his shares. Although, this is not a good sign, the motivation to sell may not always be ominous. This selling action by Mr.Clare and PVI LP could certainly indicate overvaluation.

Management and directors collectively own 6% of the outstanding shares. Directors are required to hold 3x their annual retainer in shares or deferred share units (DSUs). Directors are paid $50,000 to $60,000 annually. In 2020, the majority of the directors elected to be compensated with a tilt towards DSUs vs cash. David Clare is not remunerated for his board participation. With respect to the executive officers, the compensation is a mixture of base salary, annual bonus where 1/2 is paid in cash and the other 1/2 in stock options that vest over 5 years and expire after 10. The maximum amount of stock options to be issued as annual executive compensation is 10% of outstanding shares. In the past, they have issued ~ 1.47% of outstanding shares in stock options (with a forfeiture rate of 1.1%). All non-director employees and executive officers are eligible to participate. The company does not provide financial support to exercise these stock options. The CEO compensation is 60—70% stock options, and the remainder in cash. The other officers are compensated ~ 25% in stock options and the rest in cash.

Unfortunately, the management circular does not describe the key performance objectives for their executives.

They currently have 189 employees, up from 131 in 2017.

Investment Portfolio

In their 2021 Annual Information Form, their “investment objectives are to produce an attractive total return on our invested assets after taxes to protect and enhanced regulated underwriting capital on a long-term basis and to maintain adequate liquidity for specialty insurance operations. All investment decisions are made with the intention of providing a stable income base without producing an undue level of investment risk”. In 2018, Trisura internalized their investment management and advisory functions. Prior to this, Soundvest Capital Management and Brookfield Asset Management allocated the investment funds.

Trisura primarily invests in liquid financial instruments that are investment grade with a small amount in alternatives that include infrastructure debt and senior secured credit products. Their investment portfolio is 22% cash, 59% fixed, 9% preferred shares, 2% structured insurance assets, and 8% common equity (defensive dividend paying equities). The breakdown of their fixed income portfolio is the following: 60% AAA to A (high credit quality), 30% BBB (medium credit quality), and 10% high yield.

Their 2020 market-based yield across their investment portfolio was 3.4%. The Canadian and US portfolio generated 3.6% and 3.4% respectively.

From prior years, the Canadian portfolio generated 4.1% and 4% in 2019 and 2018 respectively. The US portfolio generated 3.5% and 4.0% in 2019 and 2018 respectively.

50% of their fixed income is from government and financials, 9.5% is from industrials, 19% is from telecom, energy, and consumer discretionary. The remainder is from power and pipelines, real estate, consumer staples, and automotives.

50% of their investment assets have maturities less than 5 years. 26% have no specific maturities and 24% have maturities over 5 years.

The only assumption I can make, without having a historical track record of their investment capabilities, is that on the surface it appears that they are conservative in their financial asset allocation. Their investment asset to equity ratio is ~ 2.2 to 2.5. With 3.4% market yield, this gives a ROE of 7.5 - 8.5%. Subjectively speaking, given the close relationship Trisura has with PVI and PVI to Brookfield Asset Management, I can only assume that there might be informal cross collaboration in terms of investment decision-making which is likely a positive attribute.

Insurance Operations

Trisura was originally founded by Mike George, John Garner, and Bob Taylor in 2006. Bob still sits on the Board of Directors. PVI started buying Trisura’s common shares in the open market beginning in ~2016 until ~2018, acquiring ~18% of the equity. There were Board and CEO changes around these times likely as a result of PVI activism.

The insurance tail of surety bonds, risk solutions (eg warranties), and corporate insurance is possibility quite long. So poor underwriting may not reveal itself for a number of years. The loss triangle is useful to see whether there were any significant reserve deficiencies that have occurred in the past. A qualitative examination reveals reserve deficiencies occurring until 2016, with majority between 2012 to 2014 in the range of $1-1.5 million. This suggests that prior management’s underwriting was suboptimal.

The more recent annual reports do not breakdown the combined ratios of these insurance divisions. However, their 2017 final prospectus does provide some insight into the profitability of these areas.

For surety, the combined ratios for 2014, 2015, and 2016 were 88.2%, 94.1% and 83%. Gross Premium growth rates were 9.8%, 3.9%, and 9.8% respectively. 80% of their surety revenue is derived from construction sector bonds, most of which are sourced from public sector infrastructure projects. The Canadian surety industry is highly concentrated with the top 5 players (Trisura being the 4th, rising from 6th in 2017) controlling 74% of the market.

Risk solutions provides coverage for company warranties, associations and groups looking after the insurance needs of their members, and fronting for captive insurance companies, MGAs, and reinsurers. The combined ratios for 2014, 2015, and 2016 were 111%, 86.7% and 139.4%. Gross Premium growth rates were 31.7%, 31.2%, and 38% respectively. There are few competitors, each with significant market share.

Corporate insurance covers directors’ and officers’ (D&O) liability, errors and omissions liability, small-to-medium business package insurance, and fidelity insurance for commercial entities and financial institutions. The D&O liability insurance is multi-year (~3) and paid in full upfront and recognized over time. The combined ratios for 2014, 2015, and 2016 were 78.9%, 86.4% and 76.9%. Gross Premium growth rates were 11%, 9.6%, and 6.9% respectively. This segment is highly competitive and possibility fragmented.

Their overall loss, expense, and combined ratio for the Canadian business in 2014 - 2020 were:

Loss ratio: 17.5%, 20.5%, 31.1%, 24%, 21.6%, 24.5%, 25.3%

Expense ratio: 72.5%, 69.8%, 61.1%, 64.9%, 64.7%, 63.3%, 60.2%

Combined ratio: 90%, 90.3%, 92.2%, 88.9%, 86.3%, 87.8%, 85.5%

ROE: 16.1%, 8.7%, 8.4%, 13.7%, 19.1%, 19.1%, 19.9%

The gross premium growth rates for the overall business in 2014-2020 were:

Growth: 15.2%, 14.3%, 19.8%, 17.5%, 12.7%, 11.5%. 51.5%,

In 2019, they formally began their fronting operations in the US so that track record is limited. The key performance metric for this business segment is the fronting operational ratio. This is defined as “the sum of claims, acquisition costs and operating expenses divided by the sum of net premium earned and fronting fees”. This is a metric that in essence describes the loss and operational expense experience relative to all the retained premiums and fronting fees. To align themselves with stakeholders, Trisura retains ~5-10% of the policy liabilities, in contrast to Markel, where 100% of the policy liabilities are given to their captive re-insurance partners.

Fronting operational ratio for 2020 and 2019 were 70.6% and 84.8%, achieving a 11.7% and 5% ROE respectively. Although there are some details on the segments in the footnotes, it is difficult to reconcile and break down these numbers to determine the actual expenses attributed to their underwriting and fronting operations. Trisura aims to target ~ 5x gross premiums written to capital on their fronting operations, so with $156 million in shareholder equity, they can write 20% and 50% more policy dollars before and with target debt capital.

They distribute their Canadian products through a network of 150 contracted brokers. They state that they are selective with their brokers, concentrating on the leaders with industry expertise. In the US, they distribute via program administrators, MGAs, insurance organizations, reinsurance companies and intermediaries.

Their main competitors are American Financial Group Inc, Arch Capital Group Ltd, Aviva plc, Intact Financial Corporation, Guarantee Company of North America, State National Companies Inc (Markel’s holding), and the Traveler’s Companies Inc. In Markel’s annual report, they state:

Many of our programs are arranged with the assistance of brokers that are seeking to provide customized insurance solutions for specialty insurance business that requires a carrier rated "A" by A.M. Best Company (Best). Our specialized business model relies on third party producers or capacity providers to provide the infrastructure associated with providing policy administration, claims handling, cash handling, underwriting, or other traditional insurance company services.

We believe there are relatively few active competitors in the fronting business. We compete primarily on the basis of price, customer service, geographic coverage, financial strength ratings, licenses, reputation, business model and experience.

Its growth strategies include acquisitions given that Trisura expects a consolidation of US and international specialty insurance and reinsurance markets. Capitalizing on tight US markets due to lack of capital to supply MGA needs coupled with reinsurance appetite for specialty insurance policies. They are also developing their own in-house IT system to manage their product lines including an online portal to rate, quote, bind, issue, and accept payments. This system processed 28,000 transactions totaling ~ $16.5 million in premiums. They also are the first Canadian surety provider to develop an e-bond for their brokers and contractors as well as on-line application and approval processing.

They aim to achieve an after-tax ROE of 15% with a combined ratio of 85%. So they would need a pre-tax 5% return on investment and ~15% underwriting return on equity.

Valuation

Given the following assumptions (refer to Trisura’s 2021 investor presentation for details (link)):

1) The US P&C market doesn’t grow (~$700 billion market) but the E&S market can reach ~10% (up from 5%) of the P&C in 8 years (~7% growth), giving a $70 billion market size,

2) Trisura US achieves 4% of the market share, equating to $2.8 billion in gross premium write. The largest P&C insurance has ~ 10% market share with most 4-5% range thereafter (link 1 and link 2),

3) To achieve this, it will need $2.8 billion divided 5 = $560 million of surplus capital (remember their target was 5:1 gross premium to surplus target),

4) Their target capital structure is 20% debt, 80% equity or $112 million debt, $448 million equity (as per their investor presentation),

5) This means that it will need to increase their capital from $195 million to $560 million ($365 million capital required or $292 million equity),

6) It retains 10% of the premiums, ceding 90%. If the fee revenue is ~ 5.8%, it would generate $146 million in fronting fees. If the operating margin is 75%, then the EBIT would be $109 million (Markel’s program services and fronting business has 80% EBITA margins),

4) It has a combined ratio of 90% on the remaining premium, it would generate $28 million in underwriting EBIT,

5) Assuming that the investment portfolio is 2:1 investment assets to equity, its portfolio size will be $448 million x 2 = $896 million. With a 3-4% return, it would generate $27-36 million pre-tax,

5) Total US EBIT = $165 - 174 million. With 4% interest rate on its debt, this would equate to $4.48 million of interest costs. With a 25% blended tax rate, the net income = $120 - 127 million,

6) If Trisura US raises debt to hits its target cap structure today, it currently has the ability to write $975 million in Gross Premiums on $195 million in surplus capital. At the same retention rate, fee and operating margins of 90%, 5.8%, and 75%, the fronting EBIT is currently $38 million. With a 90% combined ratio on its retained liabilities, it would earn $9.75 million of underwriting profit. It’s investment portfolio at 2:1 would be $312 million ($156 million x 2). At a 3-4% investment return, this would yield $9 - 12 million. The total pre-tax EBIT is ~ $57 - 60 million. At a 4% interest rate and 25% tax rate, the current net income achievable is $41 - 43 million,

7) Using the midpoint of these estimates, this would mean a growth rate of ($123/$42)^(1/8) -1 = ~ 14.4%,

8) The current normalized eps is ~$4.20. The future potential eps is ~$12.30. Assuming ~10 million shares outstanding,

9) As of April 12, 2021, the share price is $120,

10) If Trisura Canada can keep earning 15-20% on ROE, it would be deserving of 1.5-2.0x book or $15-20 per share.

11) The book value per share of Trisura International and Corporate is $2 per share.

12) So, subtracting out Trisura Canada, International, and Corporate, the Trisura US is valued at ~ $92-103/share.

13) This would give a current earnings yield of ~4.1 - 4.6% on its US Fronting business

14) If the growth is expected to be ~ 14.4%, then the total yield is ~18.5% to 19%.

15) Assuming that there is a 8% drag from additional equity capital needed and 2% drag from stock dilution over this 8 year period, at the current price, it would give a 8.5-9% total return.

Upside Optionality

The above valuation estimate does not account for several things:

a) Writing gross premiums at 5x capital with a 10% retention rate is similar to 0.5x retained premium to surplus ratio. In a hard market, it would be possible for them to write 10x capital,

b) The overall P&C market is not growing. If it continues to grow 5% per year for 8 years and the E&S market is 10% of this, the total addressable market is actually $103 billion, not $70 billion,

c) Management turns around the re-insurance business and makes it profitable,

d) Investment prowess of their team that undoubtedly will have access to Brookfield’s and Oaktree’s expertise,

e) Trisura Canada’s growth is not accounted for.

Positive attributes

1) Ability to tap into alternative investments that provide better long-term yield,

2) Financial and insurance asset-Financial and insurance liability matching as demonstrated in footnote 15.3 “Liquidity risk” in terms of maturities,

3) Minority investment in technology-driven insurance vehicles to become more efficient (a digital MGA, and an ai-enable claims processing platform),

4) Secular growing market for this insurance-as-a-service business,

5) Long-term patient ownership by Partner’s Value and Brookfield Asset Management,

6) Trisura Guarantee and Trisura Specialty have AM best rating of A- with stable outlook.

Risks (“Imagine if the stock price is now $60 per share in 5 years”)

1) Investment portfolio is poorly constructed and there are significant write-downs,

2) The recent growth of gross premium has been a result of careless underwriting, reserve deficiencies are accumulating today,

3) Competition is fierce and they can’t achieve adequate market share to make their fronting operations profitable,

4) They start to underwrite more non-governmental surety bonds and the construction industry takes a massive downturn,

5) They overpay for acquisitions (too much, poor quality insurance reserves, poorly performing employees),

6) They incentivize employees to have assume too much risk in underwriting or investment allocation.

A very brief technical analysis

The above chart demonstrates that Trisura has entered into a upward channel. Fibonacci retracement and price volume support suggest that there could be some downward volatility to catch this between $105-$120/share. There is a trending channel if it falls through $100 into a range of $80-95/share. The most prominent support line is at $80/share.

Conclusion

Despite having a massive share price run-up over the past year, the risk of dilution from private placement to build up capital in the business is gone. There is likely enough firepower in its current form to grow a business that has some industry tailwinds. The competition may not be very fierce right now which gives it some first mover advantage to reach the necessary scale. If David Clare and team are truly talented as indicated by PVI’s vetting, with his youth, coupled with the backing of Brookfield Asset Management’s ecosystem, this may turn out to be future compounder.

However, with the fierce competition in a commodity market combined with the usual opacity of the insurance liabilities, investment team processes, low interest rates, and plentiful capital to fund insurance disruptors like Lemonade and chase returns, a financial outsider needs to exercise caution.

David Gardner recommends equally weighting all positions at 5%. Ted Seides also suggests unless one is using a rigorous conviction weighting process (which I don’t have), an equal weighting approach as well. With my aim to have ~ 30-40 businesses in my portfolio (Gardner - Kretzmann continuum # of 0.67-0.88), this would be a ~ 2.5% position.

At its current price, it is a bit pricey, a pull back to the mid $80-95/share range would be a better entry point.

Useful Reference Articles

Alexander Steinberg Part 1 and Part 2

Understanding Insurance Reserves (link)